The Single Strategy To Use For Whole Farm Revenue Protection

Wiki Article

Whole Farm Revenue Protection Can Be Fun For Anyone

Table of ContentsAn Unbiased View of Whole Farm Revenue ProtectionAn Unbiased View of Whole Farm Revenue ProtectionSome Known Details About Whole Farm Revenue Protection The Greatest Guide To Whole Farm Revenue ProtectionUnknown Facts About Whole Farm Revenue ProtectionRumored Buzz on Whole Farm Revenue ProtectionThe Only Guide for Whole Farm Revenue Protection

Farm and also ranch residential property insurance covers the possessions of your ranch as well as cattle ranch, such as livestock, equipment, buildings, installments, as well as others. Consider this as industrial residential property insurance coverage that's entirely underwritten for organizations in agriculture. These are the typical coverages you can get from ranch and also ranch home insurance policy. The devices, barn, equipment, equipment, livestock, supplies, and equipment sheds are beneficial properties.Your farm as well as ranch utilizes flatbed trailers, enclosed trailers, or utility trailers to haul items as well as equipment. Commercial auto insurance policy will certainly cover the trailer but only if it's attached to the insured tractor or truck. Therefore, if something happens to the trailer while it's not connected, after that you're left on your own.

Workers' payment insurance coverage supplies the funds a staff member can make use of to get medicines for a job-related injury or disease, as prescribed by the physician. Employees' compensation insurance policy covers rehabilitation.

Whole Farm Revenue Protection Can Be Fun For Everyone

You can insure yourself with employees' compensation insurance. While acquiring the policy, providers will certainly give you the liberty to include or omit on your own as an insured.

Unknown Facts About Whole Farm Revenue Protection

Numerous ranch insurance policy carriers will additionally supply to compose a farmer's automobile insurance policy. In some situations, a farm insurance policy provider will just offer specific kinds of car insurance coverage or just guarantee the automobile risks that have procedures within a specific range or scale.

No issue what provider is writing the farmer's auto insurance plan, hefty and also extra-heavy trucks will certainly require to be placed on a business car plan. Trucks labelled to a commercial farm entity, such as an LLC or INC, will certainly need to be put on a business policy regardless of the insurance coverage copyright.

If a farmer has a semi that is made use of for carrying their very own ranch products, they may be able to include this on the exact same commercial automobile policy that insures their commercially-owned pickup. If the semi is utilized in the off-season to haul the items of others, most typical farm as well as industrial car insurance service providers will not have an "cravings" for this kind of threat.

Some Known Details About Whole Farm Revenue Protection

A trucking policy is still a business auto policy. Nonetheless, the service providers who use insurance coverage for operations with automobiles utilized to carry products for third celebrations are generally specialized in this sort of insurance coverage. These types of procedures produce greater threats for insurance companies, larger insurance claim quantities, and a greater extent of insurance claims.A seasoned independent representative can assist you figure out the sort of plan with which your industrial lorry should be insured as well as clarify the nuanced implications as well as insurance policy implications of having multiple car plans with different insurance coverage providers. Some More Bonuses trucks that are used on the farm are insured on personal car policies.

Business vehicles that are not eligible for a personal car plan, but are utilized specifically in the farming procedures provide a decreased threat to insurance provider than their commercial use equivalents. Some service providers decide to guarantee them on a ranch automobile policy, which will certainly have a little different underwriting standards and score frameworks than a routine commercial vehicle policy.

Some Known Facts About Whole Farm Revenue Protection.

Many farmers relegate older or restricted use automobiles to this kind of enrollment since it is a cost-efficient means to keep a lorry in use without all of the additional expenses normally related to automobiles. The Division of Transportation in the state of Pennsylvania categorizes a number of various kinds of unlicensed ranch trucks Kind A, B, C, as well as D.Time of day of use, miles from the home farm, as well as various other limitations apply to these kinds of automobiles. It's not an excellent idea to delegate your "daily motorist" as an unlicensed farm lorry. As you can see, there are multiple types of ranch vehicle insurance coverage site available to farmers.

The 5-Minute Rule for Whole Farm Revenue Protection

It's essential to review your lorries as well as their usage openly with your representative when they are structuring your insurance policy portfolio. This kind of detailed, conversational approach to the insurance purchasing procedure will certainly assist to guarantee that all coverage voids are shut and discover here you are obtaining the biggest worth from your policies.Please note: Information as well as claims presented in this content are meant for interesting, illustrative functions and also need to not be taken into consideration legitimately binding.

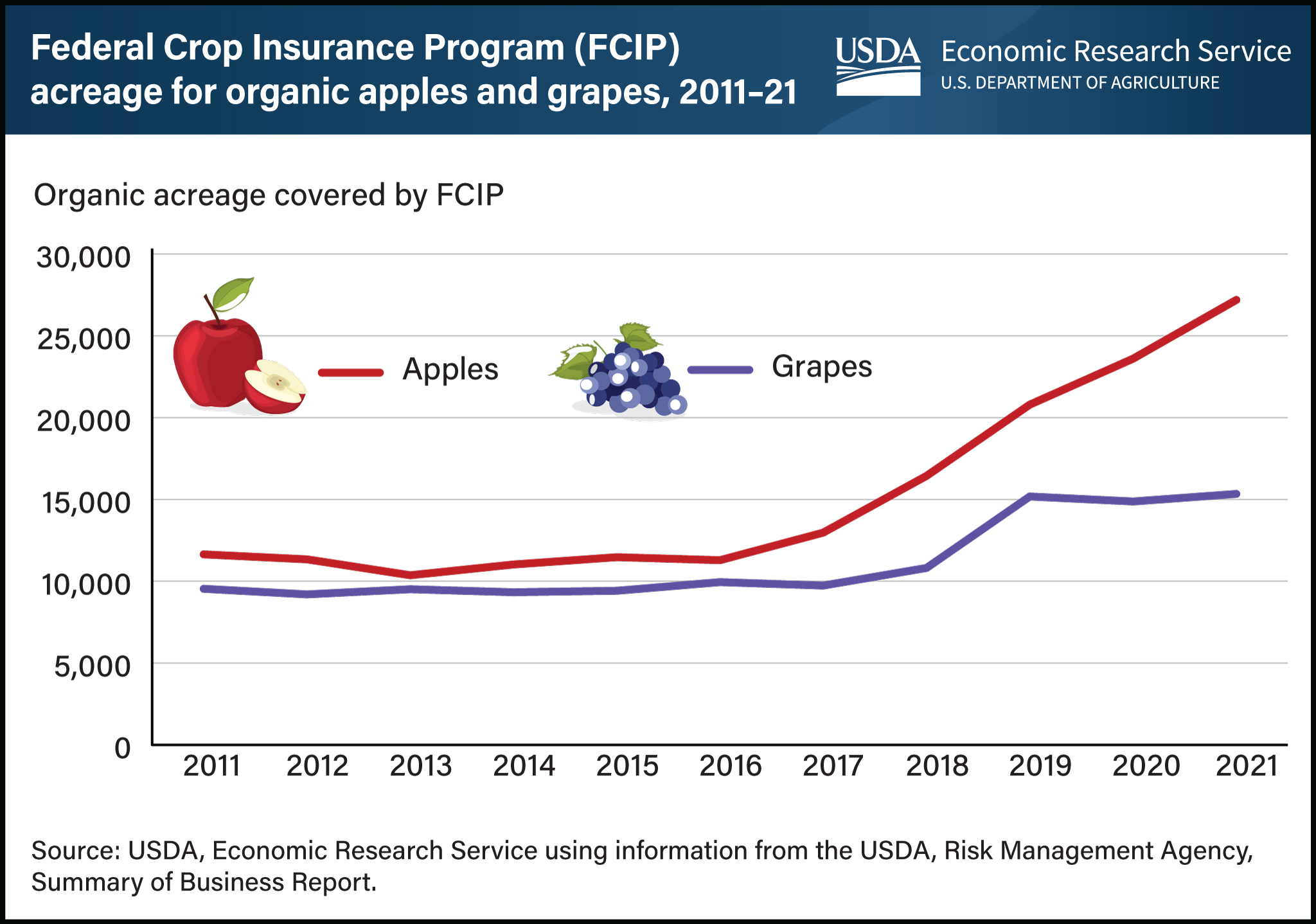

Plant hail protection is sold by private insurance companies and also regulated by the state insurance departments. There is a government program giving a selection of multi-peril crop insurance coverage products.

See This Report about Whole Farm Revenue Protection

Unlike other sorts of insurance coverage, plant insurance is reliant on established dates that apply to all policies. These days are figured out by the RMA in advance of the growing season and released on its internet site. Dates vary by plant as well as by region. These are the essential days farmers ought to anticipate to satisfy: All plant insurance applications for the assigned region as well as plant schedule by this day.Report this wiki page